According to different studies conducted by well-known research groups Global Industry Analysts, BCC Research, and Freedonia, the worldwide economic growth will continue to fuel the demand for primary and secondary consumer batteries over the coming years. These two key market segments of battery which have been the contents of many global industry reports since the past decades will be the highlight of this post.

Key Market Segments

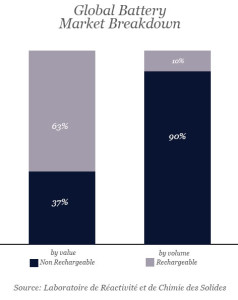

Primary batteries or the non-rechargeable type accounts for about 90% of all batteries in the world in terms of volume. Non-rechargeable batteries include zinc-carbon, manganese zinc alkaline, lithium, and zinc air. Secondary batteries or the rechargeable type, on the other hand, accounts for only about 10%. However, it significantly represents a whooping 60% of the global battery market in terms of value. Rechargeable batteries includes lead-acid, Nickel-cadmium (NiCd), Nickel metal-hydride (NiMH), lithium-ion (Li-On) and lithium-polymer (Li-Poly).

From our previous posts, we learned that lead acid battery is basically consisting of lead anode and lead dioxide cathode in an electrolyte solution of sulfuric acid. Its two categories are the flooded and sealed (or the SLA cells). NiCd which is mostly used as back-up power and on power-tool applications has longer life than lead-acid. NiMH has higher energy density than lead-acid but has a shorter cycle life than NiCd. The most popular Li-On has very high energy-to-weight ratio, slow loss of charge during idle state, and very low memory effect.

Overview of the 2009 Reports

To further understand the behavior of the global battery market, let us first examine these 2009 reports from two research groups.

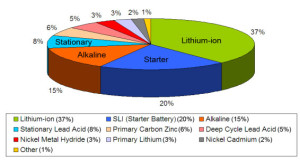

According to Frost & Sullivan, in 2009, the expanding battery market was reported to reach the global revenue of $47.5 billion. Primary batteries made up 23.6% while rechargeable batteries accounted for 76.4% of this revenue. Expected to increase to 82.6% by 2015, here is the graph showing the revenue contributions of different secondary battery chemistries.

Revenue Distributions by Different Battery Chemistries

Image Source: Battery University Website

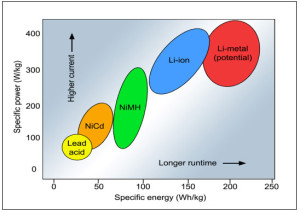

The advancement in rechargeable batteries can be attributed to the continuous research and development in increasing the specific energy for longer runtimes and improving the specific power for good power delivery on demand. Here is another graph showing the performance of specific energy and specific power of rechargeable batteries.

Specific Energy and Specific Power of Rechargeable Batteries

Image Source: Battery University Website

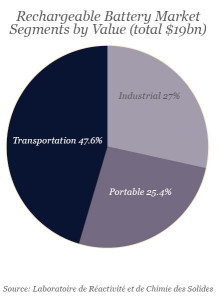

Another research group reported closer figures to that of Frost and Sullivan. In terms of value, the rechargeable battery market accounts for 63% of the total market. That is equivalent to around $19 billion of a total market valued at $30 billion. The non-rechargeable battery market accounts for only 37% of the total market value. That is equivalent to $11 billion. Here are their summary reports.

Images Source: Cleantech Magazine Website

The 2015 to 2017 Forecasts

In terms of volume and value, China is seen to lead the global consumer battery market by 2017. South Korea, India, Iran, Argentina, Poland and Indonesia are also expected to rise against the competition. However, the rate of expansion in the mature markets of Japan, USA, and European Union is expected to decline by 2017.

For primary batteries, the demand is expected to increase at the rate of 3% per year. This will bring the battery market to around $5.5 billion on 2015. In the same year, alkaline batteries are forecasted to increase to more than 70% of the overall battery demand. The demand growth for lithium batteries is also seen to increase by 2015. This big demand remains attributed to the consumer applications market which will represent about two-thirds of the overall demand by 2017.

Secondary batteries are forecasted to grow to about $21.5 billion in 2017. Lithium polymer batteries are still seen to be the biggest contributor to this forecasted growth.

In the US, the primary and secondary battery market is forecasted to grow at a yearly rate of almost 5%. This will reach to almost $17 billion by 2015. The growth is attributed to the stable demand for lead-acid and the continuously growing demand for lithium-based rechargeable batteries.

Battery Control Technology – A Big Potential Market

At present, the effort for improving the energy density of batteries remains to be a challenging job to many scientists. At the rate of only 5% per year, it is being left behind by the processing power of electronic devices that doubles every 18 months. But despite of this, one emerging battery technology where scientists and industry leaders are spending much of their time and efforts today is the Battery Control Technology. The microelectronic battery charger controller technology is the most promising in this technology. By linking this technology to other emerging battery industries, they are seeing that this sector will experience vast growth in the coming years. Moving forward, this seen explosive growth in battery control technology will soon become the contents of global battery industry reports published by various research groups.

Related articles: